PaysafeCash Deposit (via Paysafecard)

Paysafecash is an alternative cash-based payment method that makes it possible for the customer to pay securely and easily with cash on the Internet. Using Paysafecash, products or services can be ordered online and then paid for with cash offline at the nearest payment point by scanning a QR/barcode.

The following method IDs are covered in this section:

ID | Name | Credit/ Debit State |

|---|---|---|

422 | PaysafeCash Deposit | ExecutedByProvider |

425 | PaysafeCash Refund | Refunded |

Payment method interaction type: Redirection to External Payment Provider (see Interaction Types).

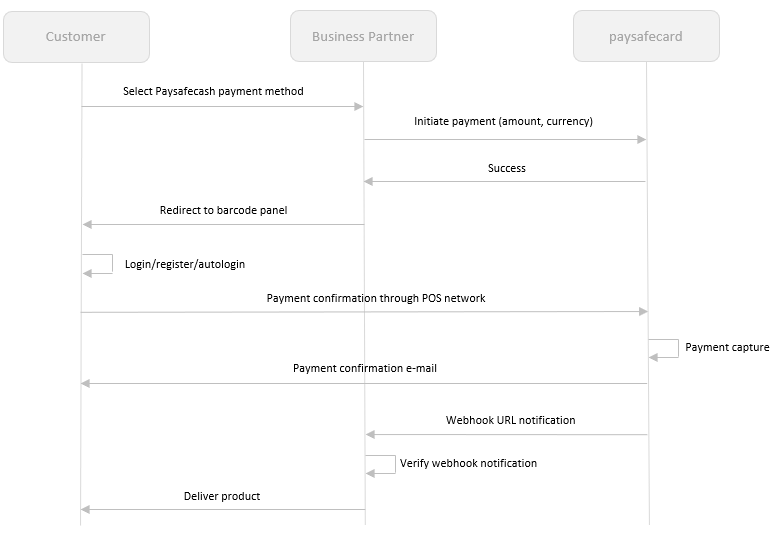

- The customer selects Paysafecash as the preferred payment option in the merchant’s webshop.

- The business partner initiates the payment with the correct amount, currency and other parameters.

- The business partner redirects the customer to Paysafecash's hosted barcode application.

- The customer has 30 minutes to login with its Paysafecash username/password and generate a barcode. The barcode will only be valid for this specific transaction.

The barcode can be viewed in various ways (e.g. online, Paysafecash app, download, e-mail, SMS or iOS / Android passbook file). - The customer brings the barcode to a payment point, has it scanned and pays for the transaction amount. A predefined time frame ("Transaction Timeout”) will be available for the payment completion.

The duration of this time frame is by default 72 hours, unless specified otherwise by the business partner. - Once the payment is done at the POS, the money will be assigned to the transaction and paysafecard captures the payment on behalf of the business partner.

- A webhook notification request is sent to the business partner.

- The business partner must verify the webhook notification.

- Upon successfully verifying the webhook notification, the business partner completes the transaction in its database and delivers the product/service to the customer.

Redirect Integration

Currently not supported.

Backend2BackendIntegration

For non-US countries: Sending data of the user would improve user's experience by pre-populating his/ her data in the registration form for Paysafecard. The following parameters can be provided in the initiatePaymentRequest.userData xml section:

key (value type, account type, required) | value |

|---|---|

firstname (string, optional) | The user´s first name |

lastname | The user´s last name |

dateOfBirth | The user's date of birth |

address.street | The user's street |

address.houseNumber | The user's house number |

address.postalCode | The user's postal code |

address.city | The user's city |

address.countryCode2 | The user´s country code |

telephoneNumber | The user´s telephone number |

email | The user’s email address |

For US: Paysafecard account is not required and the barcode is directly displayed to the user upon creating an order.

Use same UserID for all payments initiated by the user

userIDshould be the same for all payments of the customer.

Example initiatePayment request:

<initiatePaymentRequest xmlns="http://www.cqrpayments.com/PaymentProcessing"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns:xsd="http://www.w3.org/2001/XMLSchema">

<merchantID>B2BTestMerchant</merchantID>

<shopID>B2BPaysafeCashShop</shopID>

<merchantTransactionID>{{$guid}}</merchantTransactionID>

<paymentMethodID>422</paymentMethodID>

<amount currencyCode="EUR">15.00</amount>

<userID>TestUser_Paysafecash_01</userID>

<userData>

<username>TestUser_Paysafecash_01</username>

<firstname>John</firstname>

<lastname>Doe</lastname>

<email>[email protected]</email>

<address>

<street>Marxergasse</street>

<houseNumber>1b</houseNumber>

<postalCode>1010</postalCode>

<city>Vienna</city>

<countryCode2>AT</countryCode2>

<telephoneNumber>00437778889999</telephoneNumber>

</address>

<dateOfBirth>1986-10-10T00:00:00</dateOfBirth>

<gender>Male</gender>

<identificationNumberType xsi:nil="true" />

<drivingLicenseNumber xsi:nil="true" />

<drivingLicenseIssuingState xsi:nil="true" />

</userData>

<userIP>127.0.0.1</userIP>

<userSessionID>7d810381-7449-4c6a-8bfd-6967880ceae6</userSessionID>

<creationTypeID>1</creationTypeID>

<specificPaymentData>

<data xsi:type="keyStringValuePair">

<key>SuccessPageUrl</key>

<value>https://www.pxpfinancial.com</value>

</data>

<data xsi:type="keyStringValuePair">

<key>ErrorPageUrl</key>

<value>https://pxpfinancial.com/failed</value>

</data>

</specificPaymentData>

</initiatePaymentRequest>Example initiatePayment response:

<initiatePaymentResponse xmlns="http://www.cqrpayments.com/PaymentProcessing" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<payment xsi:type="paymentWithPaymentAccount">

<merchantID>B2BTestMerchant</merchantID>

<shopID>B2BPaysafeCashShop</shopID>

<paymentMethod>

<key>422</key>

<value>PaysafeCash Deposit</value>

</paymentMethod>

<merchantTransactionID>8dfb0adc-5a02-4e80-a765-ff7832f7157d</merchantTransactionID>

<paymentID>cd3e55b5-cdf8-47fd-900b-dd65e8cdf29a</paymentID>

<userID>TestUser_Paysafecash_01</userID>

<paymentProvider>

<key>19</key>

<value>Paysafecard</value>

</paymentProvider>

<amount currencyCode="EUR">15.00</amount>

<creationType>

<key>1</key>

<value>User</value>

</creationType>

<userIP>127.0.0.1</userIP>

<state>

<id>3d9015bf-4051-4c77-89e8-86e98cb35b6f</id>

<definition>

<key>30</key>

<value>RedirectURLCreated</value>

</definition>

<createdOn>2021-10-08T11:37:10.4330194Z</createdOn>

<paymentStateDetails>

<detail xsi:type="keyStringValuePair">

<key>RedirectionUrl</key>

<value>https://customer.test.at.paysafecard.com/rest/payment/panel?mid=1090001806&mtid=pay_1090001806_5402f924-93fa-4d94-aa50-1f573f4b360f_EUR&amount=15.00&currency=EUR</value>

</detail>

<detail xsi:type="keyStringValuePair">

<key>PaymentStateReasonID</key>

<value>1</value>

</detail>

</paymentStateDetails>

</state>

<isExecuted>false</isExecuted>

<baseAmount currencyCode="EUR">15</baseAmount>

<paymentDetails>

<detail xsi:type="keyStringValuePair">

<key>ProviderTransactionID</key>

<value>pay_1090001806_5402f924-93fa-4d94-aa50-1f573f4b360f_EUR</value>

</detail>

<detail xsi:type="keyStringValuePair">

<key>ProviderExternalID</key>

<value>38277625</value>

</detail>

</paymentDetails>

</payment>

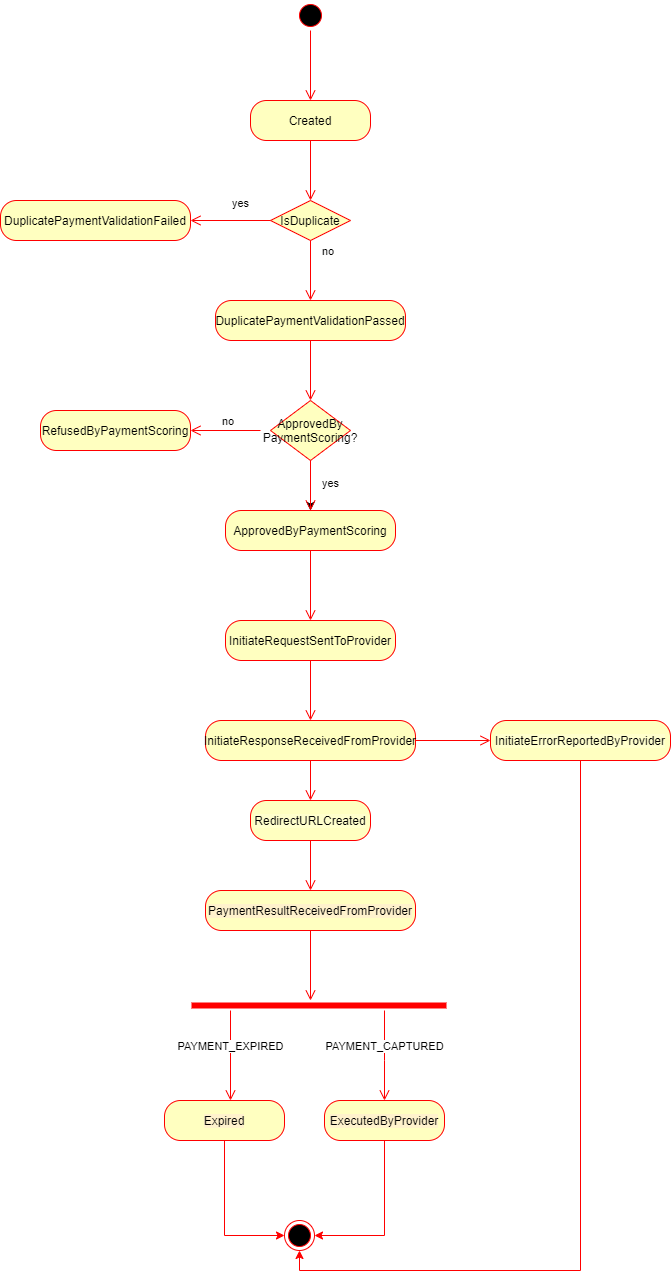

</initiatePaymentResponse>The below diagram shows the workflow of states for PaysafeCash Deposit:

Refund

The refund feature provides the business partners the possibility to fully or partially refund a previously paid transaction back into the customer‘s my paysafecard account.

- the customer needs to have paysafecard account

- Refund is possible up to 45 days after the initial payment

- Refund transaction must refer to a previous transaction

- Only the full or less/partial amount can be refunded, higher amount can not be refunded

- Refund will always be issued in the currency of the original payment transaction

Refunds are available only for non-US countries!

For triggering a card deposit refund the initiatePaymentFromReferenceRequest should be invoked.

The following fields should be provided in the initiatePaymentFromReference request:

Field | Description |

|---|---|

amount | The amount to be refund to the customer credit card. Partial refunds are possible. |

paymentMethodID | 425 |

merchantTransactionID | The unique ID of the payment assigned by the merchant |

originalPaymentID | The |

specificPaymentData.PaymentDescription | Your reason for the refund |

Example initiatePaymentFromReference request:

<initiatePaymentFromReferenceRequest

xmlns="http://www.cqrpayments.com/PaymentProcessing"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns:xsd="http://www.w3.org/2001/XMLSchema">

<merchantID>B2BTestMerchant</merchantID>

<shopID>PaysafecashPTShop</shopID>

<originalPaymentID>cd3e55b5-cdf8-47fd-900b-dd65e8cdf29a</originalPaymentID>

<merchantTransactionID>refa5998ec6-b460-4c12-81dd-b92a387cce2e</merchantTransactionID>

<paymentMethodID>425</paymentMethodID>

<amount currencyCode="EUR">10.00</amount>

<specificPaymentData>

<data xsi:type="keyStringValuePair">

<key>PaymentDescription</key>

<value>YourReasonForRefund</value>

</data>

</specificPaymentData>

</initiatePaymentFromReferenceRequest>Example initiatePaymentFromReference response:

<initiatePaymentFromReferenceResponse xmlns="http://www.cqrpayments.com/PaymentProcessing" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<payment xsi:type="paymentWithPaymentAccount">

<merchantID>B2BTestMerchant</merchantID>

<shopID>PaysafecashPTShop</shopID>

<paymentMethod>

<key>425</key>

<value>PaysafeCash Refund</value>

</paymentMethod>

<merchantTransactionID>refa5998ec6-b460-4c12-81dd-b92a387cce2e</merchantTransactionID>

<paymentID>cd3e55b5-cdf8-47fd-900b-dd65e8cdf29a</paymentID>

<userID>TestUser_Paysafecash_01</userID>

<paymentProvider>

<key>19</key>

<value>Paysafecard</value>

</paymentProvider>

<amount currencyCode="EUR">10.00</amount>

<creationType>

<key>2</key>

<value>MerchantOperator</value>

</creationType>

<userIP>127.0.0.1</userIP>

<state>

<id>1d67e89e-c39d-4bba-b24e-2ac3b305db07</id>

<definition>

<key>125</key>

<value>Refunded</value>

</definition>

<createdOn>2021-09-13T14:51:53.0059561Z</createdOn>

<paymentStateDetails xsi:nil="true"></paymentStateDetails>

</state>

<isExecuted>true</isExecuted>

<baseAmount currencyCode="EUR">10</baseAmount>

<paymentDetails>

<detail xsi:type="keyIntValuePair">

<key>OriginalPaymentID</key>

<value>37920005</value>

</detail>

<detail xsi:type="keyStringValuePair">

<key>ProviderTransactionID</key>

<value>ref_1100003139_LSdvzAuT7TI5x7E7P8BZJybXTveOagjO_EUR</value>

</detail>

<detail xsi:type="keyStringValuePair">

<key>ProviderExternalID</key>

<value>37920045</value>

</detail>

</paymentDetails>

</payment>

</initiatePaymentFromReferenceResponse>Notifications

The standard notification mechanism is used for notifying the merchant in the background (asynchronously) about payment state changes. For more information see PaymentStateChangedNotification.

Notifications are sent for the following two states: ExecutedByProvider (142) and Expired (102).

Error Codes

When an error occurs, the payment is moved to state 'InitiateErrorReportedByProvider' - errors logged in the payments stated additional details in field 'ProviderErrorCode' and 'Provider Error Message'.

Code | Description |

|---|---|

10007 | General technical error. |

10008 | Authentication failed due to missing or invalid API key. Your key needs to be set to the HTTP auth username. |

10028 | One of the request parameters failed validation. The |

142 | The supplied currency is not supported |

2001 | Transaction already exists. |

2002 | Transaction not found |

3001 | Merchant is not active. |

3007 | Debit attempt after expiry of dispo time window. |

3014 | The |

3037 | The time set in the parameter "expiration_time_minutes" is not in the allowed span (between 5 and 20160 minutes). |

3172 | Feature not active disabled |

3017 | It is mandatory to send an MCID. |

3019 | MCID contains invalid values. |

Updated 9 months ago