3DS 2.0 Pass through payments

Introduction

This page aims to describe the authorisation flow to merchants with a backend-to-backend integration to the PXP Financial Payment Service, but who have integrated with a third-party 3DS Server to perform 3DS2 authentication.

In this scenario, the merchant need only pass through the key data elements for a 3DS2 authorisation, unlike the full Browser-based flow for 3DS 2.0

Process Overview

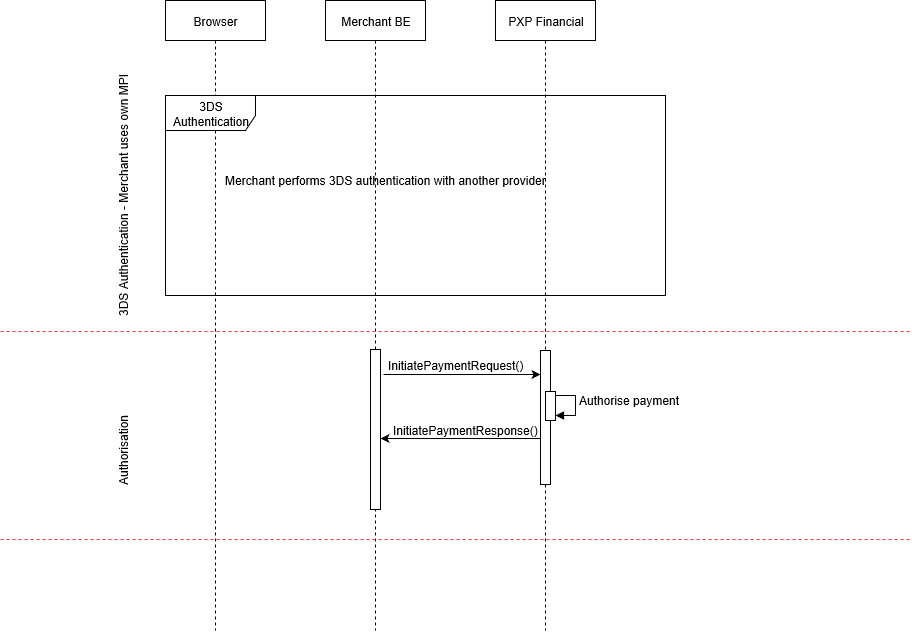

A pass through 3DS2 authorisation will be initiated from a merchant front-end, via a backend-to-backend call to PXP Financial after the merchant has carried out 3DS2 authentication with a third-party 3DS Server and has the necessary data elements for authorisation as indicated below.

The diagram below illustrates the sequence of steps for each stage of the authentication:

Pre-requisites

- You must have a test account set up for use with PXP Financial

- If you are an existing merchant you should already have a fully integrated backend-to-backend integration in place

- If you are a new merchant please refer to the Initiate New Payment (Backend2Backend) section

Integration Steps

Step 1: Create a new payment with 3DS2 authentication data

Submit initiatePaymentRequest

initiatePaymentRequestThe initiatePaymentRequest has been extended with new fields to support pass through 3DS2 authentication. Existing merchants will need to extend their existing integration and send these fields in addition to those that they usually send.

The table below lists the 3DS2 fields that should be obtained from your 3DS2 Provider and sent in the initiatePaymentRequest (see here for API documentation). These fields should be provided in initiatePaymentRequest.specificPaymentData.

Please note, all fields should be provided where possible.

| Field | Description |

|---|---|

| ThreeDSecureTransactionStatus | The Transaction Status value in the ARes or CRes depending on whether the authentication was frictionless or not |

| ThreeDSecureVersion | The 3DS2 protocol version |

| ThreeDSecureCAVV | Corresponds to the authentication value. |

| ThreeDSecureECI | Electronic Commerce Indicator |

| DirectoryServerTransactionID | The unique ID assigned the Directory Server for this payment |

PSD 2 Compliance and flagging exemptionsIf an exemption has been granted during authentication through another 3DS2 provider, it must be flagged in the

initiatePaymentrequest. See below for more details.

If an exemption was requested and granted to the payment during authentication, the respective exemption ID must also be sent in ScaExemptionID field in initiatePaymentRequest.

Field | Description |

|---|---|

ScaExemptionID | Indicates the exemption type that has been granted by Issuer for the particular transaction. |

For more information about PXP's PSD2 Framework refer to PSD 2 Implementation Guide.

Example initiatePaymentRequest:

<?xml version="1.0" encoding="utf-8"?>

<initiatePaymentRequest xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns="http://www.cqrpayments.com/PaymentProcessing">

<merchantID>3DSv2_TestMerchant</merchantID>

<shopID>3DSv2_TestShop</shopID>

<merchantTransactionID>01eb5797-2e6b-4dd9-9938-e68a215f45ce</merchantTransactionID>

<paymentMethodID>2</paymentMethodID>

<amount currencyCode="EUR">10</amount>

<userID>f9651638-2f0f-4f54-ab3f-8513ea897876</userID>

<userData>

<username>f9651638-2f0f-4f54-ab3f-8513ea897876</username>

<firstname xsi:nil="true" />

<lastname xsi:nil="true" />

<currencyCode xsi:nil="true" />

<languageCode xsi:nil="true" />

<email xsi:nil="true" />

<address xsi:nil="true" />

<identificationNumberType xsi:nil="true" />

<drivingLicenseNumber xsi:nil="true" />

<drivingLicenseIssuingState xsi:nil="true" />

</userData>

<userIP>127.0.0.1</userIP>

<userSessionID>dc138506-2d2b-4d90-9cbb-92cf0879bd76</userSessionID>

<creationTypeID>1</creationTypeID>

<specificPaymentData>

<data xsi:type="keyStringValuePair">

<key>PaymentDescription</key>

<value>dd86a2f5-e53e-4a09-ab0e-1d9de6089742</value>

</data>

<data xsi:type="keyStringValuePair">

<key>PaymentDescriptionLanguageCode</key>

<value>en</value>

</data>

<data xsi:type="keyIntValuePair">

<key>PaymentProviderID</key>

<value>92</value>

</data>

<data xsi:type="keyStringValuePair">

<key>ThreeDSecureTransactionStatus</key>

<value>Y</value>

</data>

<data xsi:type="keyStringValuePair">

<key>ThreeDSecureCAVV</key>

<value>MTA4NTE4NDczNDIwNDMzNjYxODM=</value>

</data>

<data xsi:type="keyStringValuePair">

<key>ThreeDSecureECI</key>

<value>07</value>

</data>

<data xsi:type="keyStringValuePair">

<key>DirectoryServerTransactionID</key>

<value>f7ed8582-5e38-4ff9-9271-32d804436b16</value>

</data>

<data xsi:type="keyStringValuePair">

<key>ThreeDSecureVersion</key>

<value>2.1.0</value>

</data>

<data xsi:type="keyIntValuePair">

<key>ScaExemptionID</key>

<value>2</value>

</data>

</specificPaymentData>

<paymentAccount>

<specificPaymentAccountData>

<data xsi:type="keyStringValuePair">

<key>CardNumber</key>

<value>4111111372680044</value>

</data>

<data xsi:type="keyStringValuePair">

<key>HolderName</key>

<value>Jôe-Juán Säöüp</value>

</data>

<data xsi:type="keyIntValuePair">

<key>ExpiryMonth</key>

<value>12</value>

</data>

<data xsi:type="keyIntValuePair">

<key>ExpiryYear</key>

<value>2030</value>

</data>

<data xsi:type="keyStringValuePair">

<key>CardVerificationCode</key>

<value>111</value>

</data>

</specificPaymentAccountData>

</paymentAccount>

</initiatePaymentRequest>Step 2: Process authorisation response

Receive initiatePaymentResponse

initiatePaymentResponseIf authorisation is successful, initiatePaymentResponse is received with AuthorisedByProvider state (13).

Further details on initiatePaymentResponse can be found here

.

Example initiatePayment response:

<?xml version="1.0" encoding="utf-8"?>

<initiatePaymentResponse xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns="http://www.cqrpayments.com/PaymentProcessing">

<payment xsi:type="paymentWithPaymentAccount">

<merchantID>3DSv2_TestMerchant</merchantID>

<shopID>3DSv2_TestShop</shopID>

<paymentMethod>

<key>2</key>

<value>VISA Deposit</value>

</paymentMethod>

<merchantTransactionID>01eb5797-2e6b-4dd9-9938-e68a215f45ce</merchantTransactionID>

<paymentID>ea4ccfd2-c364-45db-be56-e6d2c572f602</paymentID>

<userID>f9651638-2f0f-4f54-ab3f-8513ea897876</userID>

<paymentProvider>

<key>92</key>

<value>CQRUK</value>

</paymentProvider>

<amount currencyCode="EUR">10</amount>

<creationType>

<key>3</key>

<value>Api</value>

</creationType>

<userIP>127.0.0.1</userIP>

<state>

<id>da21b481-a3e2-466f-b284-0083b501ac41</id>

<definition>

<key>13</key>

<value>AuthorisedByProvider</value>

</definition>

<createdOn>2019-07-02T13:07:25.1809956Z</createdOn>

<description>Approved or completed successfully</description>

<paymentStateDetails>

<detail xsi:type="keyStringValuePair">

<key>ProviderResponseCode</key>

<value>0</value>

</detail>

<detail xsi:type="keyStringValuePair">

<key>ApprovalCode</key>

<value>357074</value>

</detail>

</paymentStateDetails>

</state>

<isExecuted>true</isExecuted>

<baseAmount currencyCode="EUR">10</baseAmount>

<paymentDetails>

<detail xsi:type="keyStringValuePair">

<key>ThreeDSecureVersion</key>

<value>2.1.0</value>

</detail>

<detail xsi:type="keyStringValuePair">

<key>ThreeDSecureTransactionStatus</key>

<value>Y</value>

</detail>

<detail xsi:type="keyStringValuePair">

<key>DirectoryServerTransactionID</key>

<value>f7ed8582-5e38-4ff9-9271-32d804436b16</value>

</detail>

<detail xsi:type="keyStringValuePair">

<key>CardholderAuthenticationVerificationValue</key>

<value>MTA4NTE4NDczNDIwNDMzNjYxODM=</value>

</detail>

<detail xsi:type="keyStringValuePair">

<key>ElectronicCommerceIndicator</key>

<value>07</value>

</detail>

</paymentDetails>

<paymentAccount>

<paymentAccountID>a1a56d61-fe3c-4a70-a88c-443e39c59b5a</paymentAccountID>

</paymentAccount>

</payment>

</initiatePaymentResponse>

Supported ProvidersPass through payments are currently supported for:

- PXP Financial

- Braintree

- Worldpay Europe

- AIB

- Moneris

- Payfacto

We will update this page as more Providers are supported in the future.

3DS 2.0 pass through payments Integration SummaryIn order to integrate with PXP Financial for 3DS 2.0 pass through payments you will need to:

- Send additional data in

initiatePaymentRequest- Process the authorisation response as normal

Version History

| Date | Description |

|---|---|

| 4.07.2019 | Added example for initiatePaymentRequest and initiatePaymentResponse |

| 31.10.2022 | Added definition of ScaExemptionID field in relation to PSD2 framework |

| 15.01.2024 | Added list of supported providers |

Updated 9 months ago